Post COVID-19 Aviation Growth Scenario

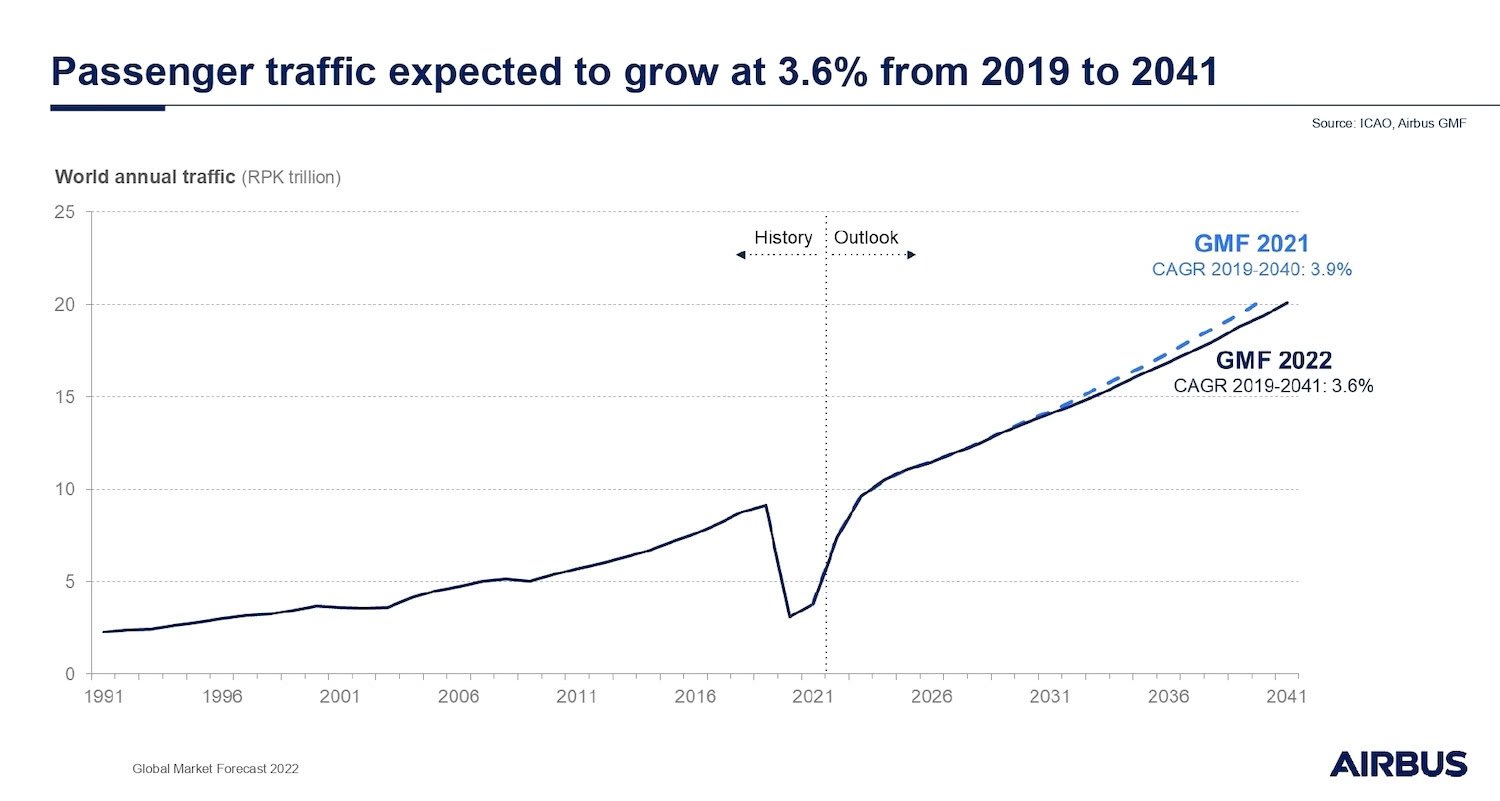

The health crisis resulting from the COVID-19 pandemic was unprecedented in 2020 and shook economic and productive expectations in all sectors worldwide. Even so, some light has already been shed on the uncertainty in the short and medium term.

Yet, despite the challenges of the past two years, flight demand levels have now returned to pre-pandemic levels. Commercial aviation remains efficient, resilient and a fundamental part of the development of the modern world.

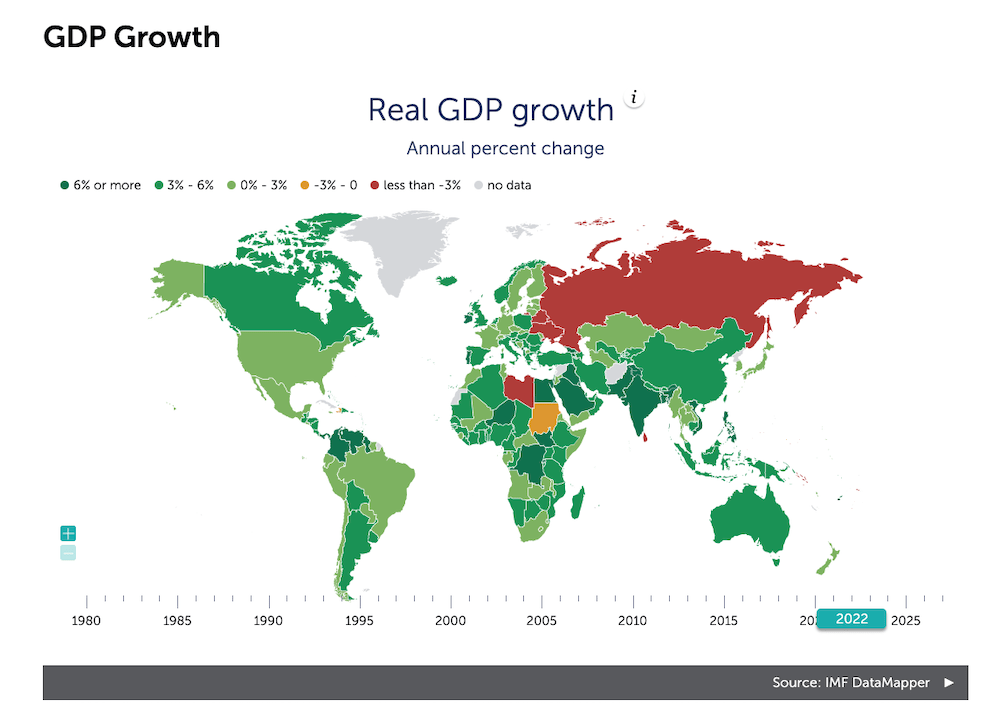

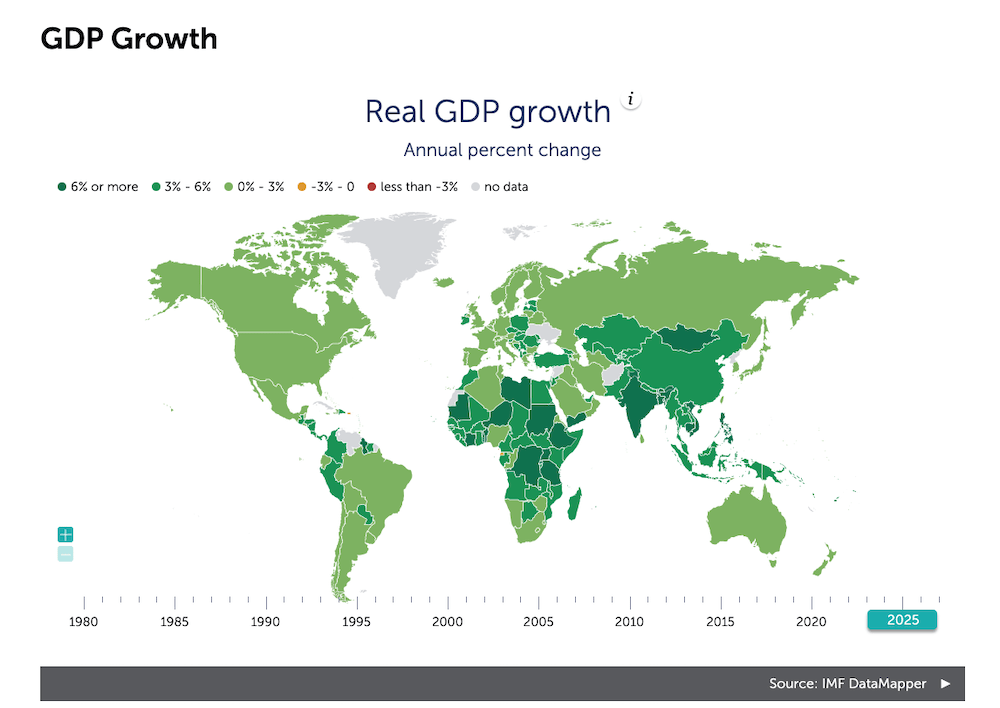

According to IATA’s annual review, by the end of 2024, all regions will have surpassed pre-pandemic flight demand. As reflected in the table above, an average positive variation in real GDP of 5.4 percentage points is expected over the next few years.

But to ensure that aviation can provide sustainable social and economic benefits while fulfilling this long-term demand, both IATA and Tourism Economics believe it is essential that governments increase their support for more efficient operations and encourage an effective energy transition.

The most salient forecasts emerging from the various studies and measurements are:

✓ By 2025, passenger numbers are expected to exceed pre-COVID-19 levels (120%).

✓ By 2030, global passenger numbers are expected to have grown to 5.6 billion.

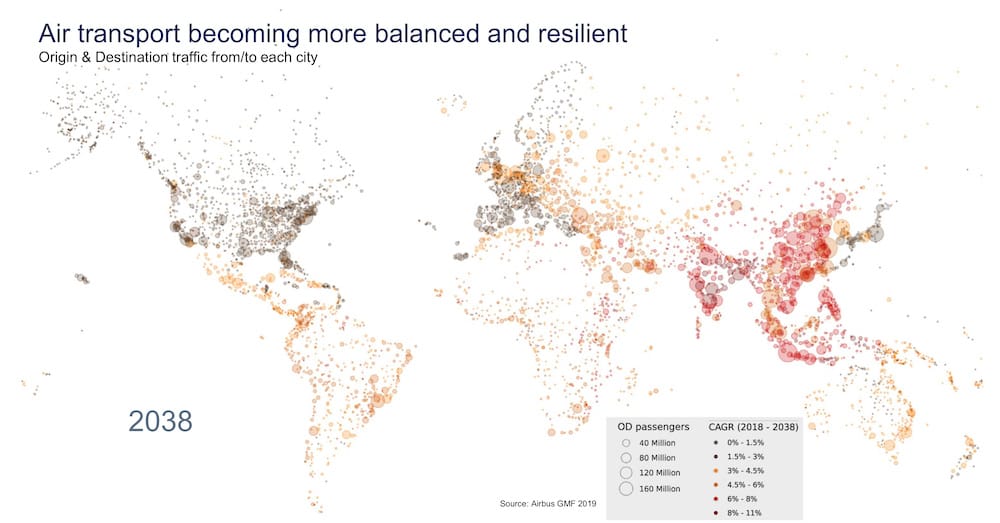

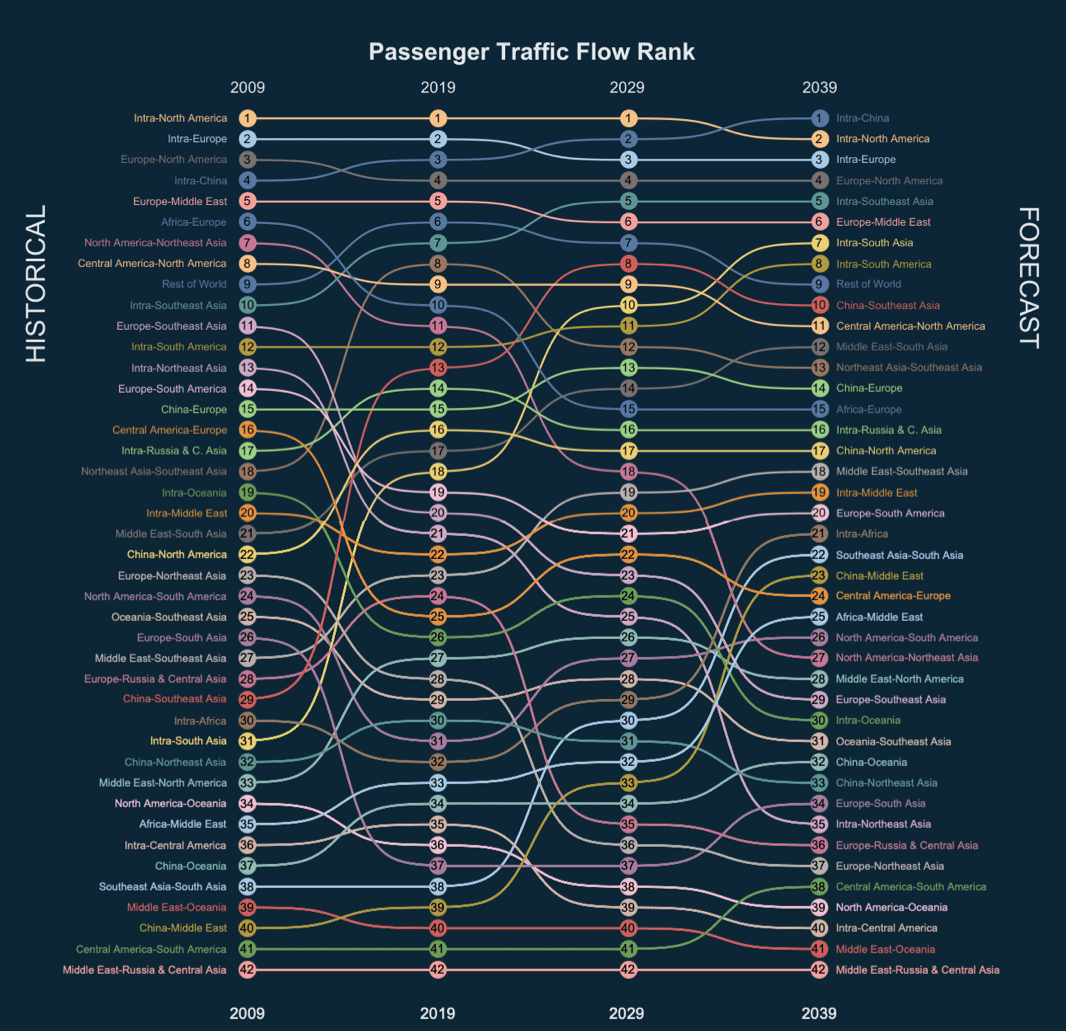

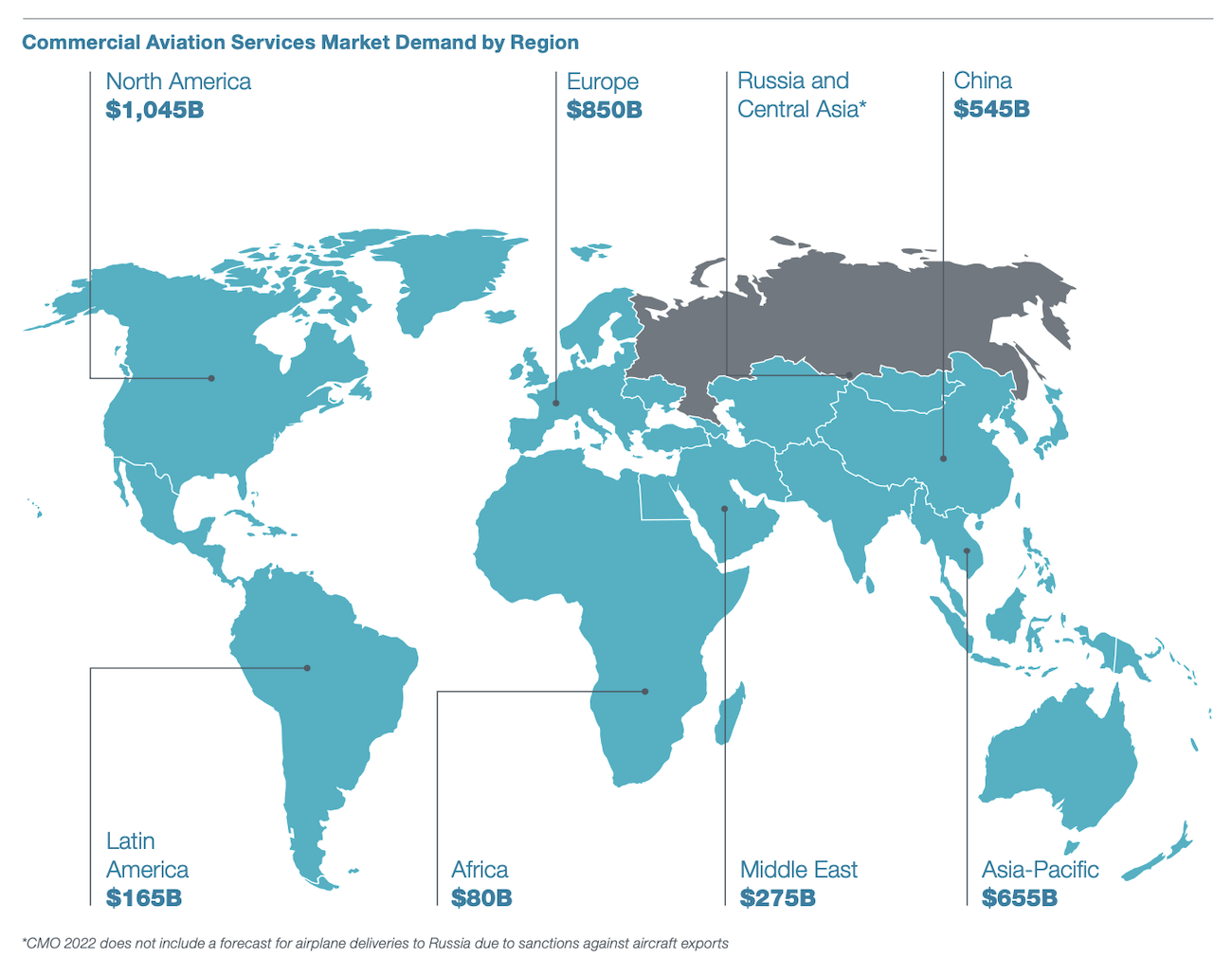

Based on the fact that commercial aviation is a global industry and is experiencing continued high growth, some markets are emerging on a significantly higher trend.

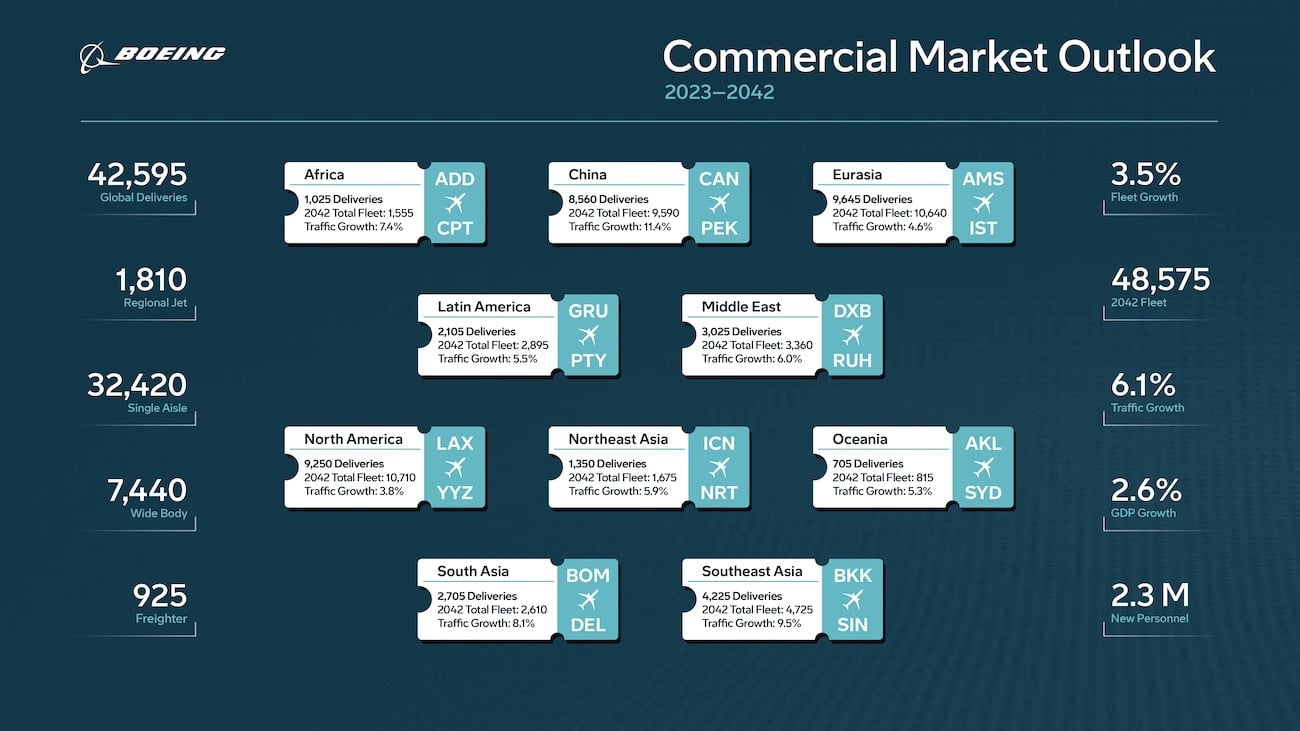

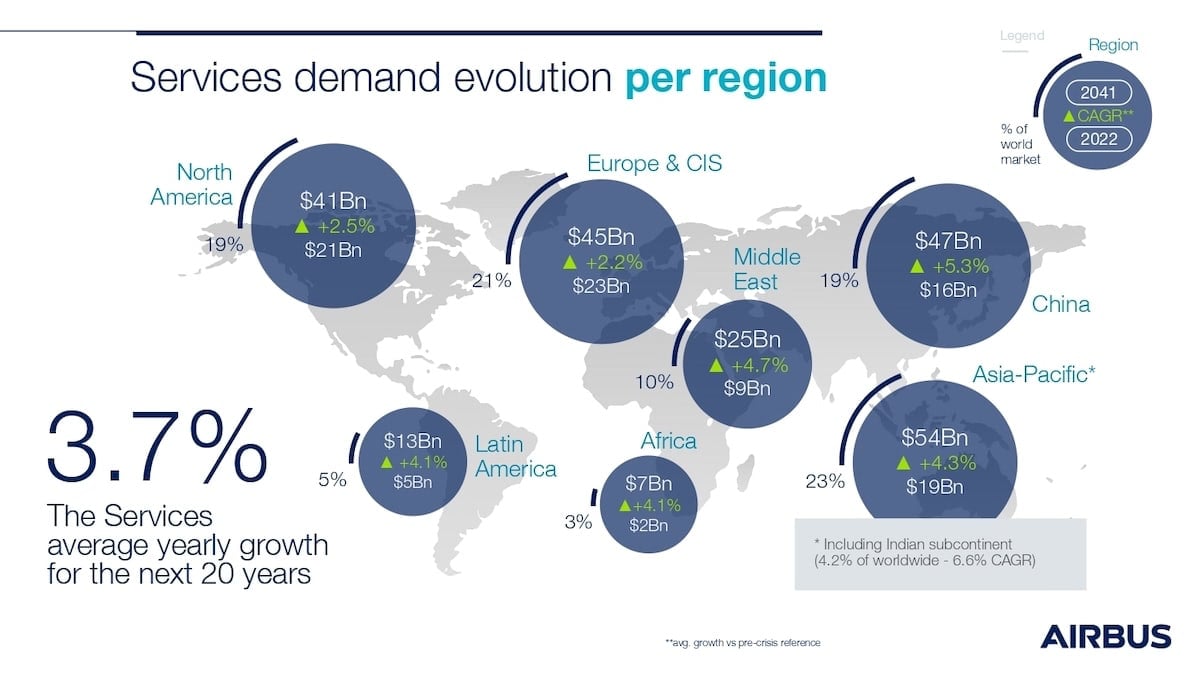

For this reason, and based on the annual reports of Boeing and Airbus published during 2023, we are going to analyse the forecasts for the future of commercial aviation at a global level, segmenting the different regions and breaking down specific data for each area.

But first, let us take a look at the different reasons that explain this increase in commercial flights and, consequently, this exponential growth in commercial aviation.

The demand for aviation personnel to meet the growth of commercial aviation globally is imminent; this is something we have confirmed in recent years.

Moreover, the figures are growing all the time, as air travel has become the most efficient means of transport for passengers and goods.

For this reason, being an airline pilot will always be a very good career opportunity; regardless of the natural cycles of economic growth and lethargy, commercial aviation is the engine that moves our world and this is an irrefutable fact.

Asia-Pacific

128.000 pilots

150.000 technicians

191.000 cabin crew

Europe + CIS

143.000 pilots

156.000 technicians

235.000 cabin crew

Middle East

58.000 pilots

58.000 technicians

99.000 cabin crew

Africa

21.000 pilots

22.000 technicians

26.000 cabin crew

China

134.000 pilots

138.000 technicians

161.000 cabin crew

In the last 15 years, the number of passengers in commercial aviation has doubled. In 2019, for example, 4.5 billion people travelled with one of the 1,300 airlines currently operating. Also, more than 24,000 commercial aircraft took off around the world, making more than 40 million flights, in just one year.

According to the UNWTO, tourism accounts for 10% of global GDP; so with 57% of the world’s cross-border tourists travelling by air, this is one of the primary sources of wealth today.

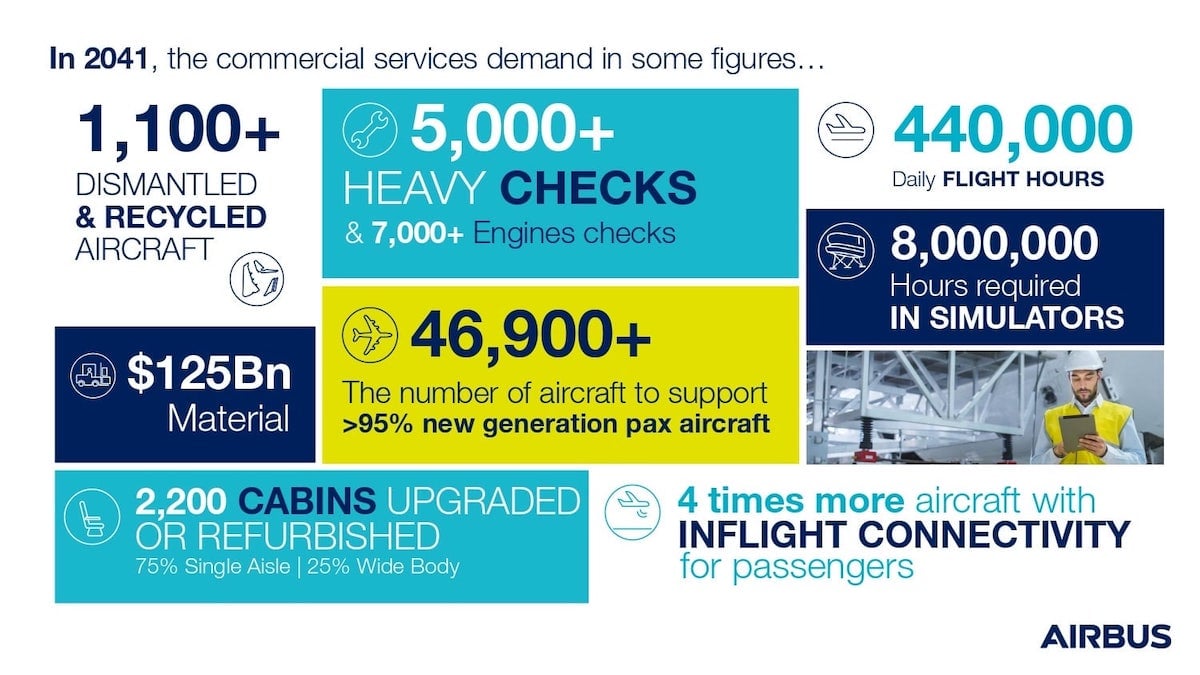

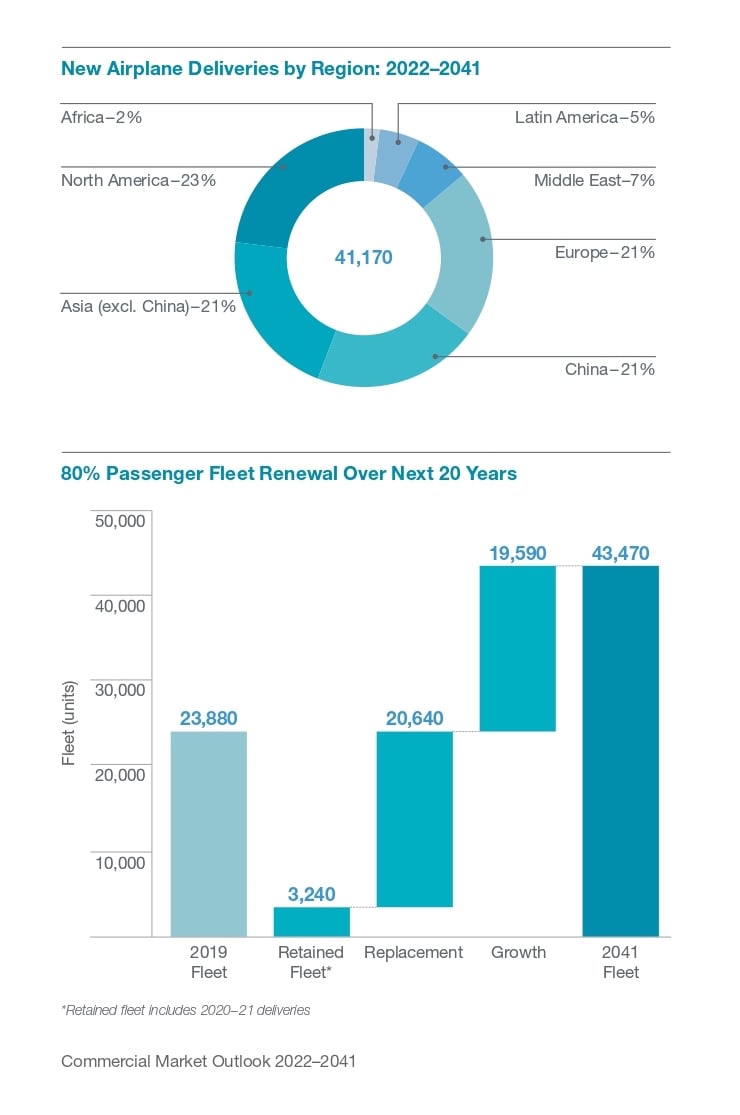

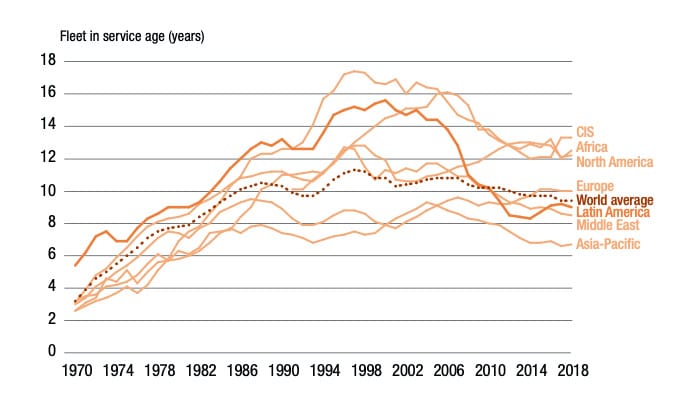

Another clear consequence of the unstoppable growth of commercial aviation is the increase in the number of aircraft in service that is expected over the next two decades.

If at the beginning of 2021, there were almost 22,000 Airbus commercial aircraft in service, this figure is expected to double by 2041, reaching nearly 45,000 aircraft.

According to Airbus, more than 39,000 new aeroplanes are scheduled to be delivered, some of which will replace the older ones and serve to modernise the world’s fleet over the next 20 years.

In the graph below, we can see how the continuity of only 6,500 of the active aircraft is foreseen at the beginning of 2021. The rest will be replaced by new, more efficient and modern models, with consequent growth for the components manufacturing sector, for example.

European political uncertainty casts a shadow that is difficult to ignore, fuelled in large part by the situation between Russia and Ukraine, rising energy prices, raw material shortages and global inflation concerns.

Still, despite the difficulties, the European commercial aviation market has remained stable in recent years. The reasons for its persistence are an increase in the flow of money, improved access to credit, a decrease in the tax burden and increased confidence among businesses and consumers.

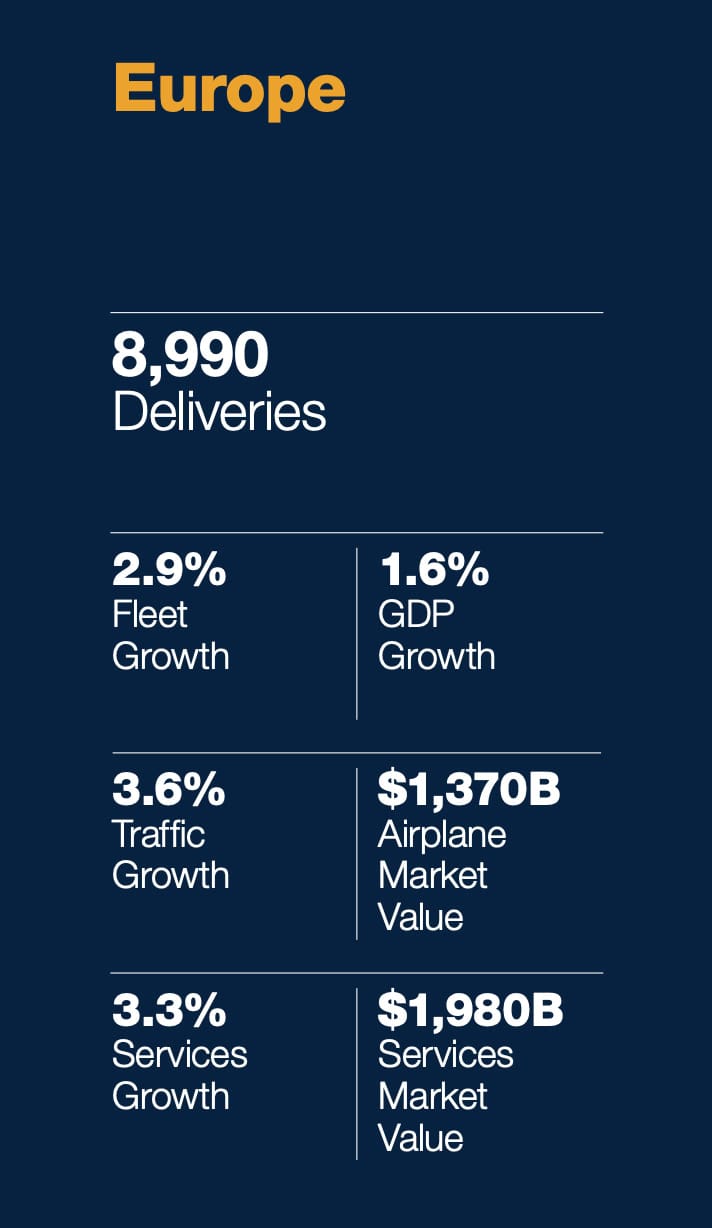

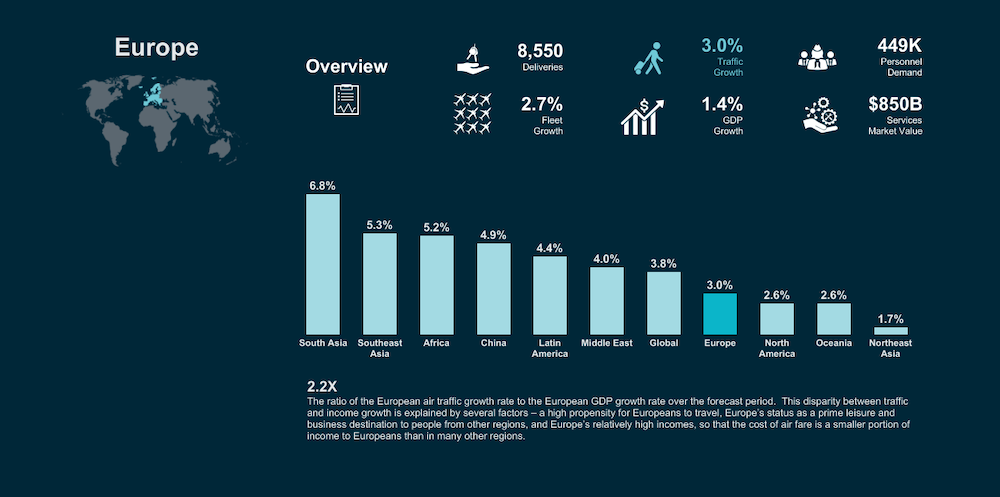

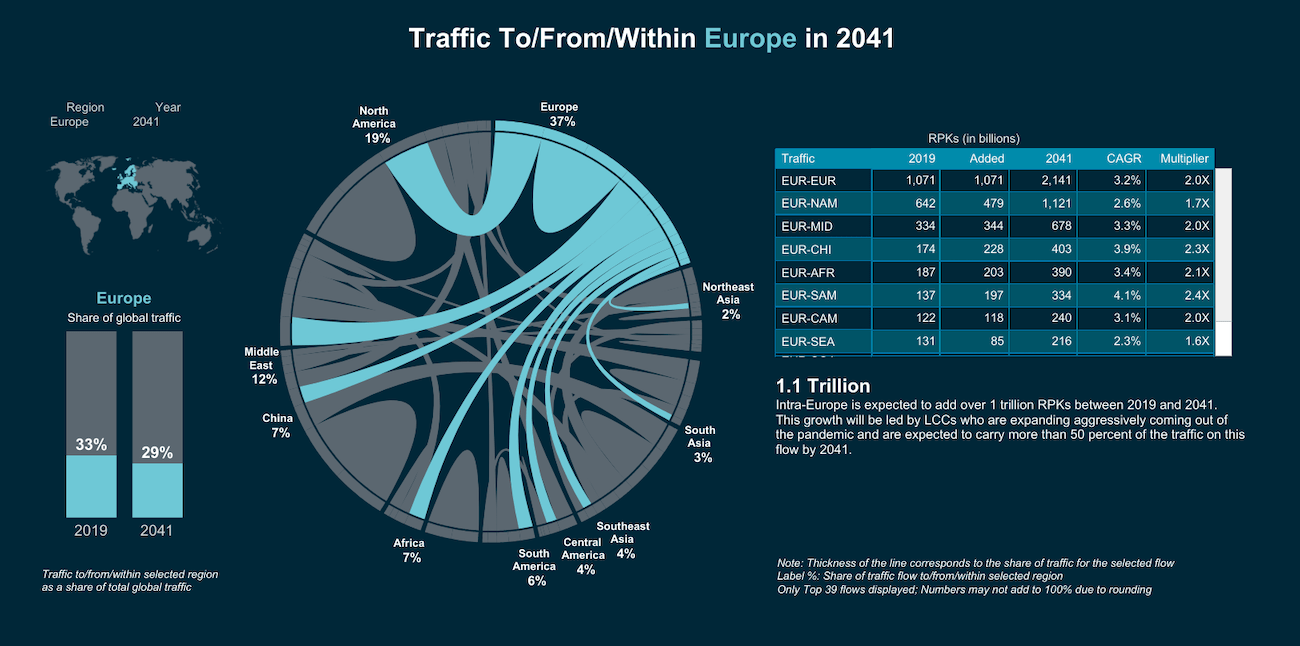

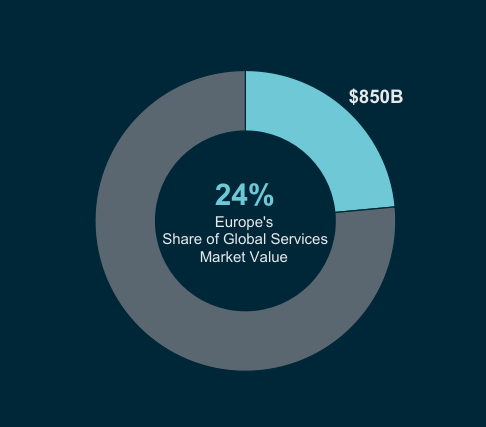

According to Airbus’ latest report, air traffic in Europe has grown by 3.6% per year accounting for one third of all flight capacity to, from and within Europe in recent years.

The airlines in the European network carried 4.3% more passengers than in the previous year. Besides, low-cost airlines in Europe recorded an increase in passenger traffic of 12.4%.

This increase in air traffic has occurred in contrast to the growth of European GDP, of only 1.8 %; which indicates that it is only one more element driving the increase in local traffic. Real GDP is expected to grow by 1.6% per year in the period 2022-2041, influenced by demographic developments in Europe.

In the coming years, the European Union faces major long-term challenges such as fiscal and financial union, as well as the need for structural reforms in the areas of labour, pensions and market liberalisation.

The rise of low-cost airlines, a major boost to the Global Aviation industry

Perhaps the most surprising strategic development in Europe in recent years has been the rapid expansion of the low-cost long-distance business model.

For example, Norwegian continues to expand its long-distance services, adding bases in cities such as Paris and Barcelona for operations to North America; it recently launched the first low-cost service from London to Singapore.

The airlines in the European network are operating low-cost long-haul flights through their subsidiary airlines; for example, Eurowings, a subsidiary of Lufthansa, has been increasing this type of flying for several years.

Also LEVEL, the new long-distance low-cost operator, which belongs to International Airlines Group, has started to operate such flights. This fact is also the case of Air France-KLM, which has also announced plans to launch low-cost, long-haul flight operations next year.

The airlines Norwegian, Eurowings, Level, Wow Air, Canadian WestJet or Air Canada Rouge, have increased their low-cost flight operations the most. They are also the leaders in demand for airline pilots for long-distance flights between Europe and North America.

It is a fact that low-cost commercial aviation will support more than 48% of total flight capacity in the coming years.

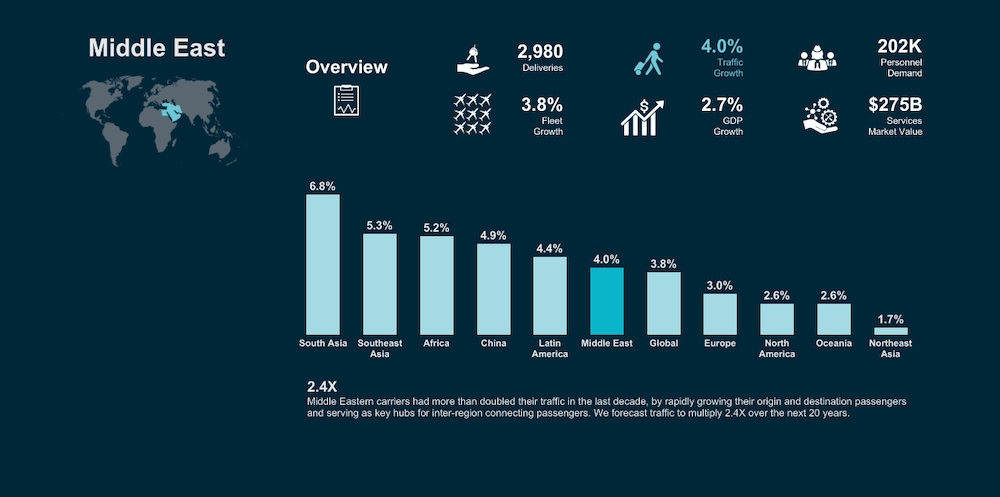

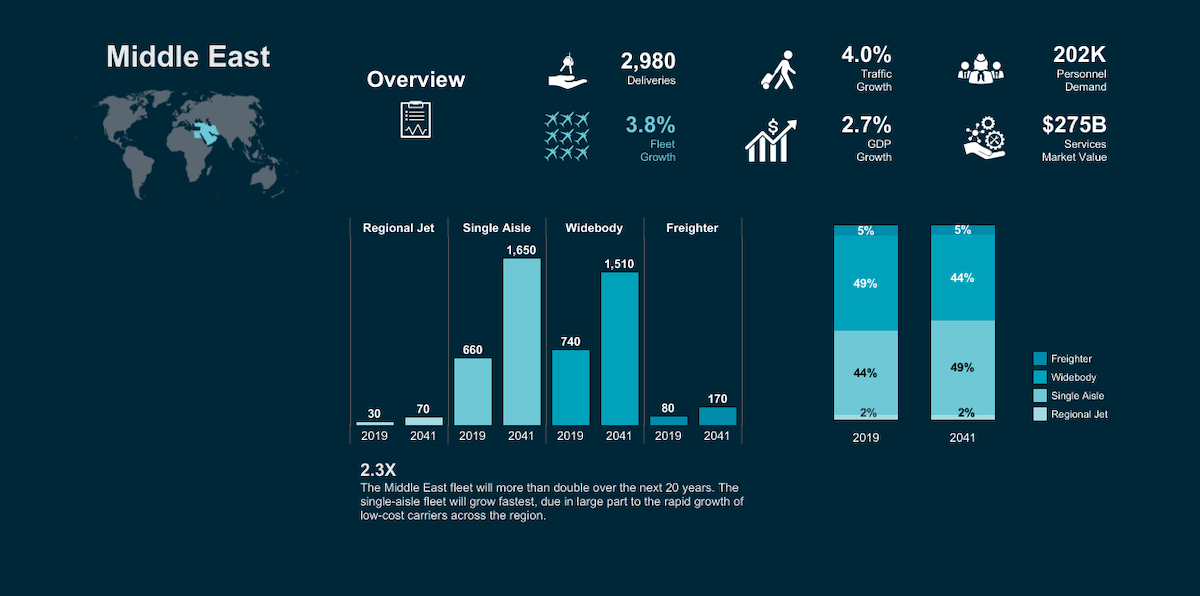

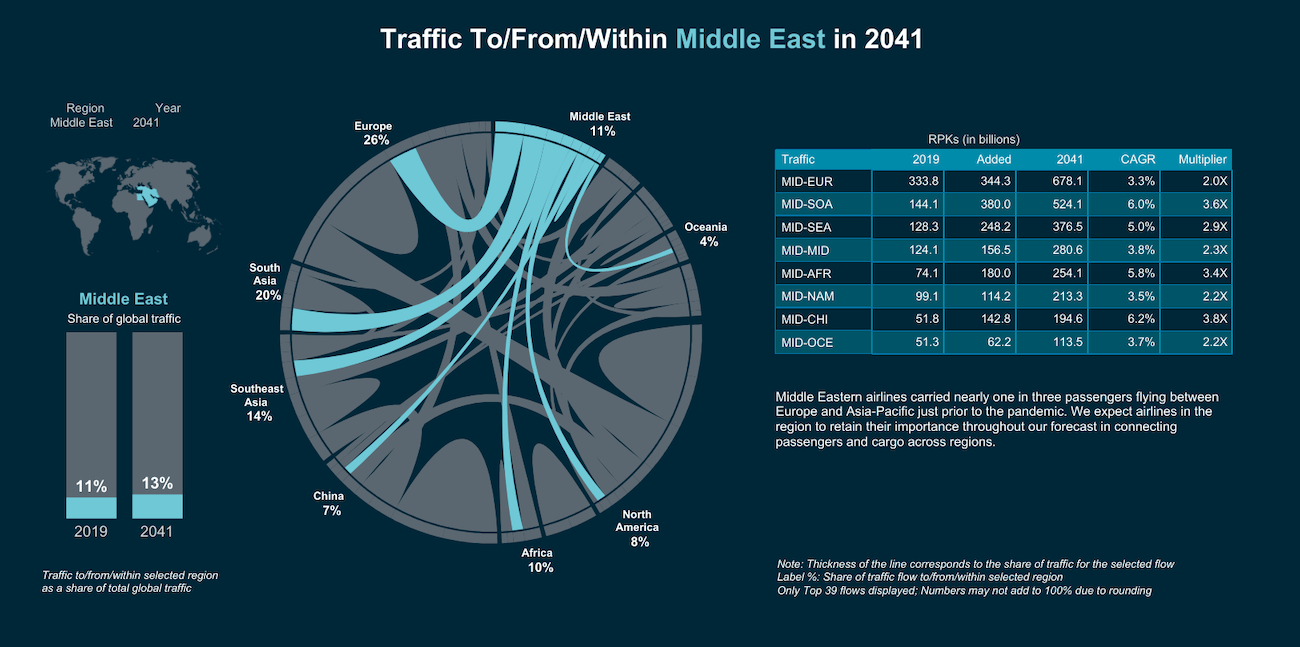

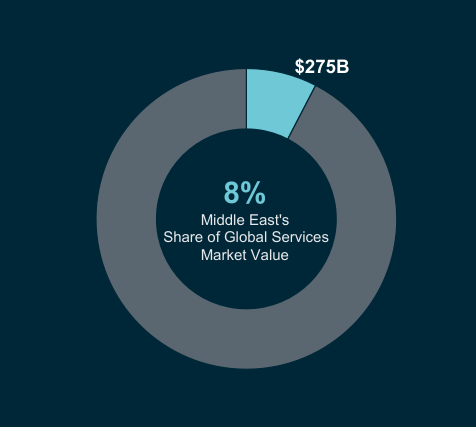

Middle Eastern airlines are well-positioned to compete for traffic connecting the continents of Asia, Africa and Europe; because 80% of the world’s population lives within eight hours of the Persian Gulf area.

This fact allows the airlines of the Middle East to operate numerous flights in their centres that, in the absence of this type of airlines, would not be able to count on these direct itineraries.

The growth prospects for commercial aviation in the Middle East are optimistic. For example, Southeast Asia has a potential of 1.8 billion passengers. This figure is driven by the actual forecast of a 3.2% annual increase in GDP over the next 20 years.

The Middle East’s economic projection is very positive thanks to its significant oil resources, its proximity to emerging Asian economies that are major energy consumers, its growing tourism boom and its strategic geopolitical location.

Although growth is expected to be slightly less notable than in the other regions, commercial aviation in the Middle East is equally strong in and around Southeast Asia and Africa.

Increased demand for travel to and from these regions is a crucial factor behind Boeing’s forecast for the region of 3,130 aircraft in the coming years.

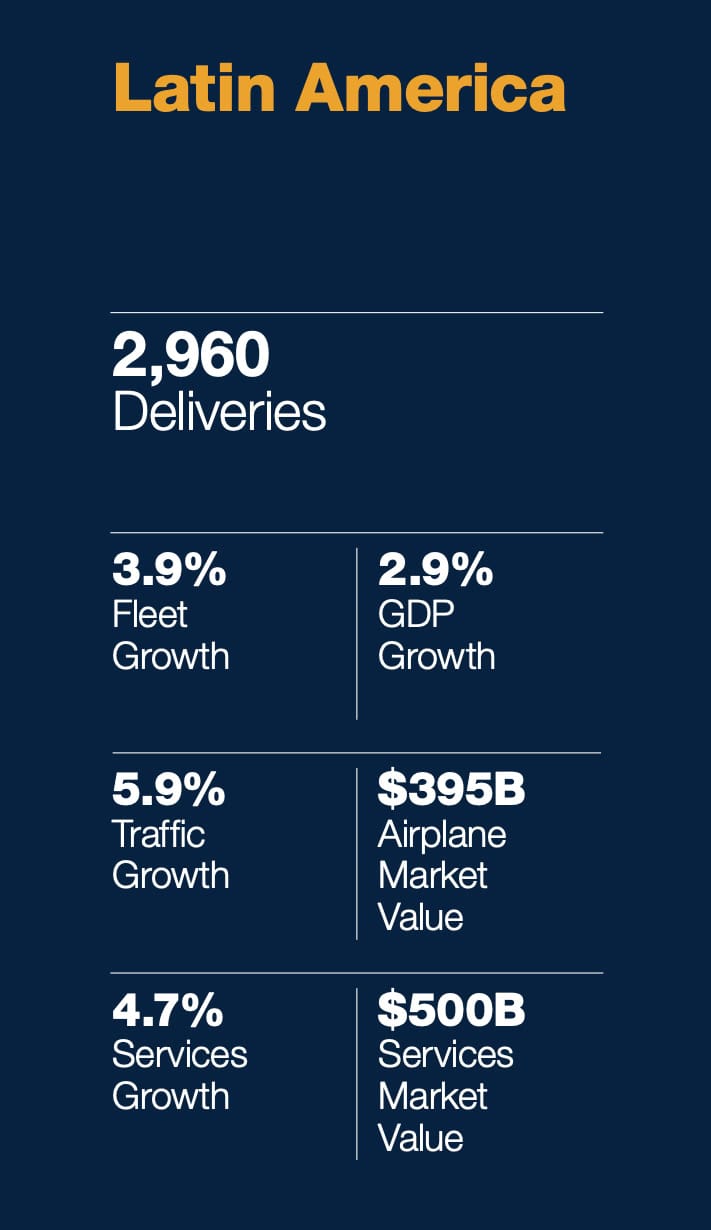

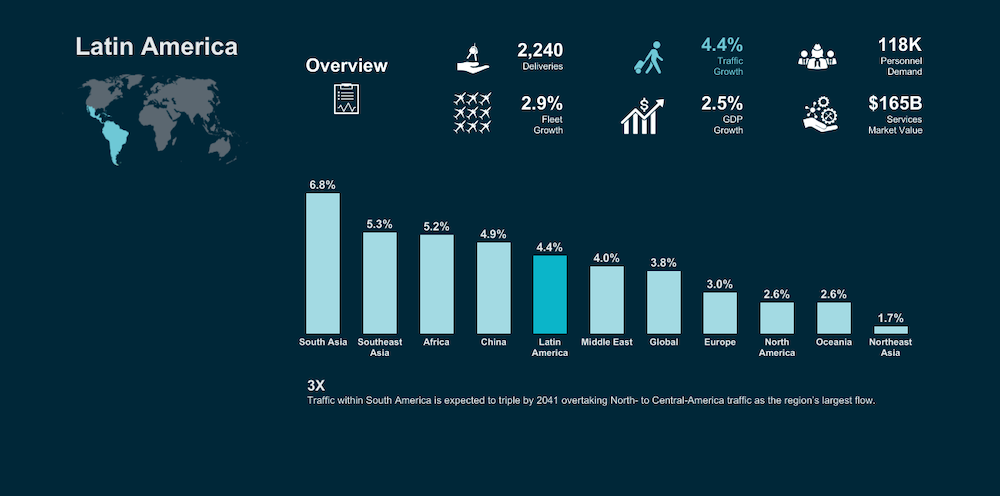

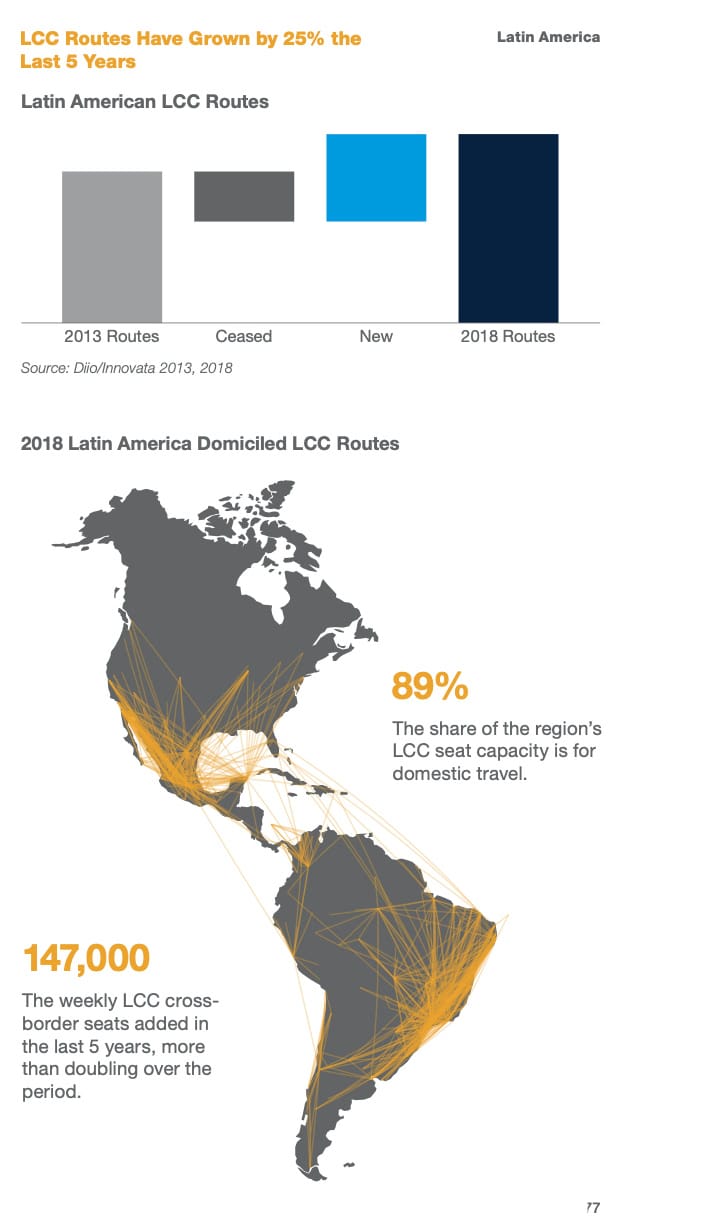

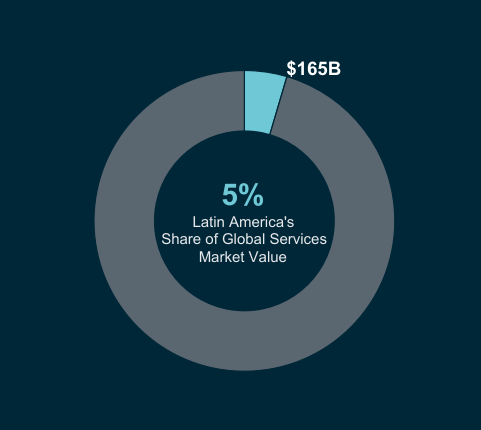

Economic growth in Latin America is as varied as the continent is vast. Thus, we find a marked recession in the countries of the interior, as opposed to the coastal states, such as Brazil, Colombia, Peru or Chile, which have positive growth forecasts.

On the other hand, Mexico sees its economy as subordinated to trade with the USA through capital inflows and asset remittances.

Despite specific long-term challenges, such as the need for infrastructure or the marked inequality of the population, the growth prospects for commercial aviation in Latin America and the Caribbean are positive.

As a positive indicator of the excellent health of the Latin American economy, its GDP is estimated to increase by an average of 2.9% per year until 2038, as well as an increase in trade of 3.2% per year for the same period.

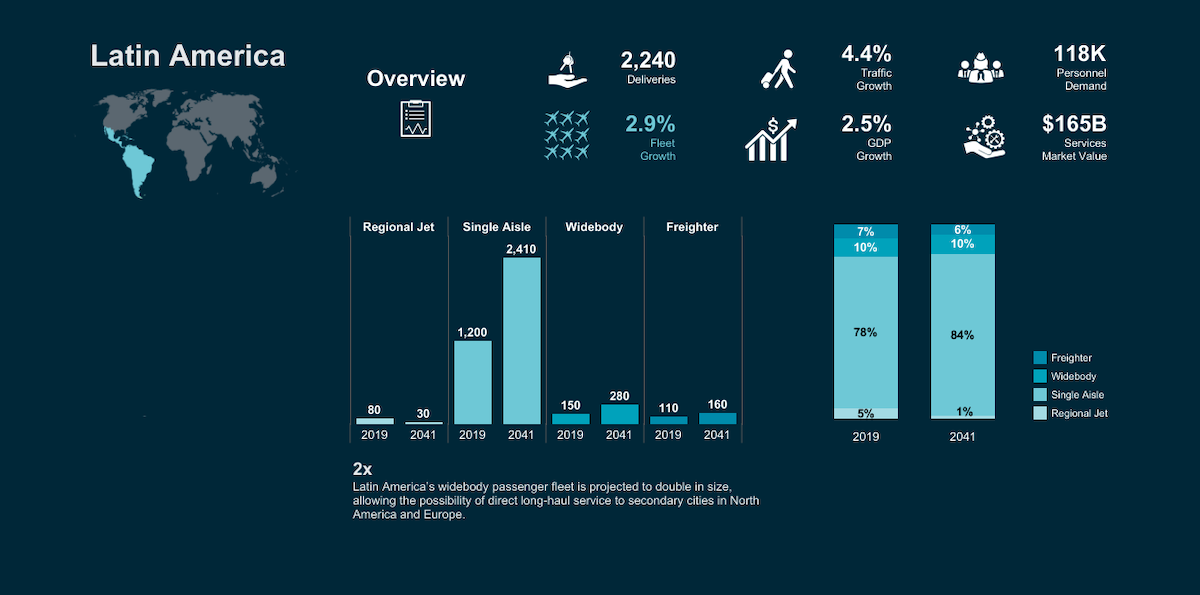

More investment in aircraft to cover both domestic and intercontinental routes

In the Latin American market, the amount of aircraft in the total fleet of operating airlines is expected to double, with single-aisle aircraft in particular.

These will be used to cover routes between countries in the region, as well as to connect the continent to medium-sized cities in North America and Europe.

Moreover, traffic growth forecasts for Latin America are firm: after years of stagnation, it is expected to be the third region in the world, after Asia and Africa, in terms of passenger flow growth, tripling the current rate.

Long distances with a poor infrastructure

Due to its large size and the real limitations of land transport, commercial aviation in Latin America plays a vital role. With 60% of its roads unpaved, South America covers almost 22,000,000 km2.

In recent years, economic factors have meant that domestic traffic growth has only achieved a rate of 1.9% per year over the past five years.

Internal traffic growth grew somewhat faster, with an average annual growth rate of 4.1% over the same period, appearing less affected by economic fluctuations in the area and even by some of the more global cyclical downturns.

Part of the reason for these different growth rates is that as carriers face problems in national markets, they try to use spare capacity within the region.

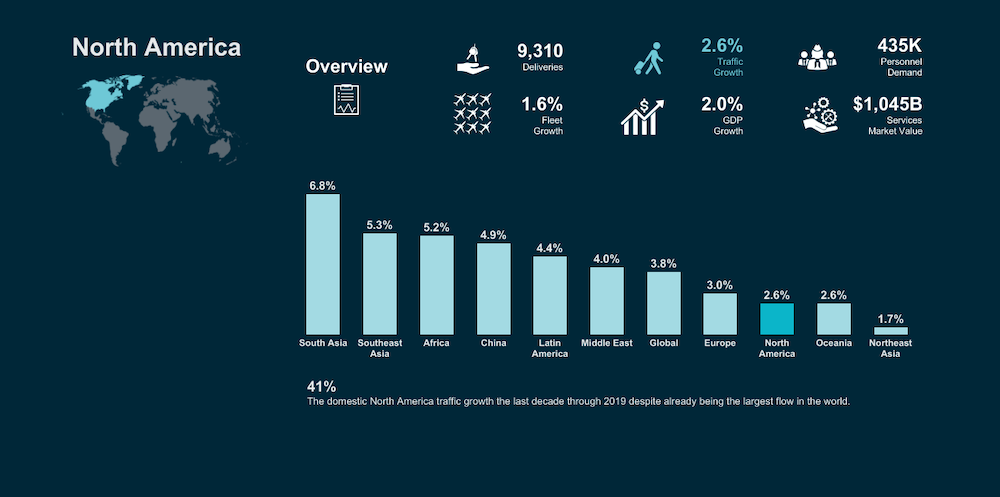

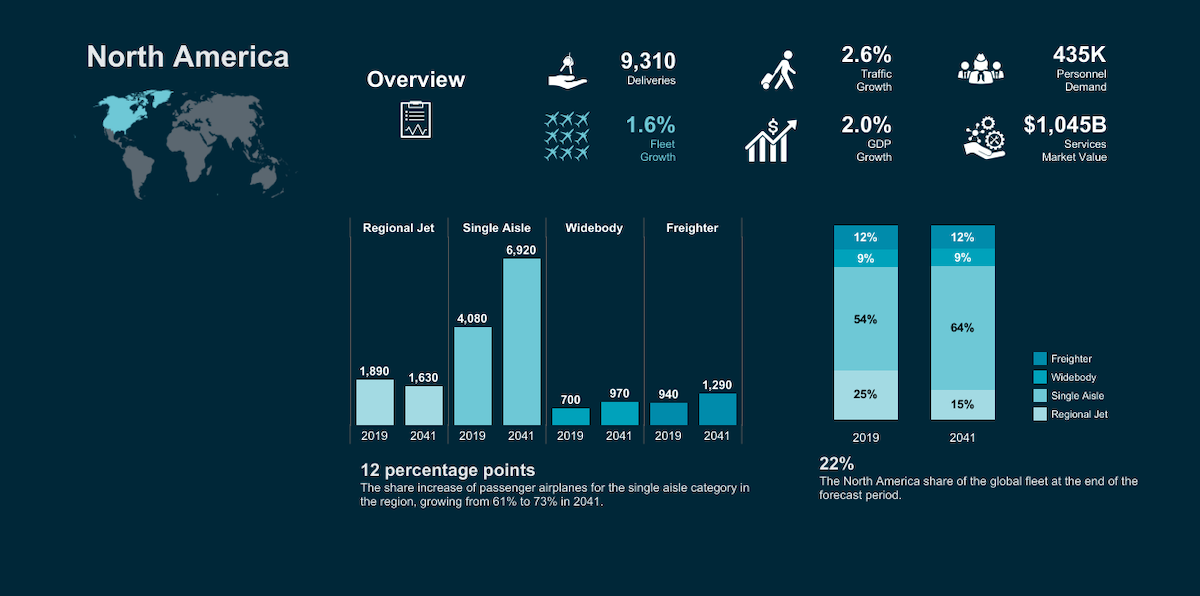

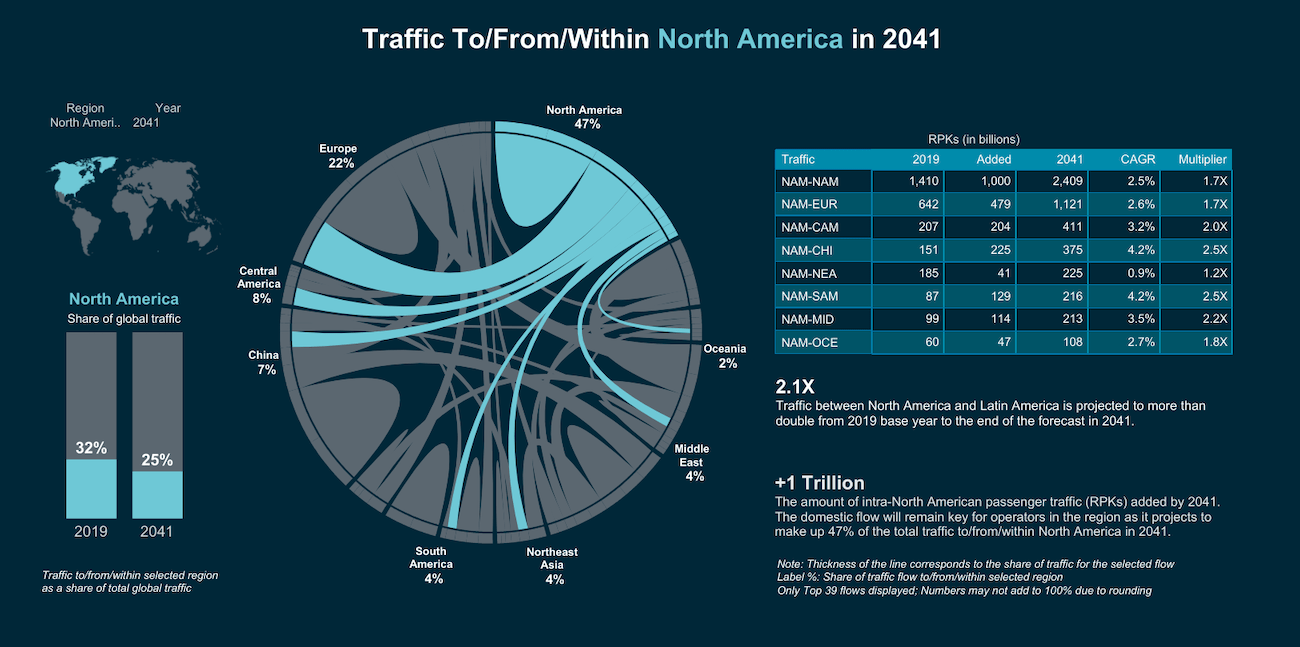

North America is composed of two major and mature economies, US and Canada, which have established aviation markets. This area is forecast to be the leader in both per capita GDP and per capita travel rates.

After several significant crises in the last decade, as well as a series of subsequent mergers, the U.S. fleet has begun to grow again, increasing by 6% in the last two years and eclipsing its previous peak in 2007. The period of restructuring has considerably improved the productivity of the region’s airlines.

Cargo ratios have increased from 72% to 83% since 2000. The region’s carriers are also improving, and the region’s airlines are also optimising their aircraft capacity.

The fleet of single-aisle aircraft has remained unchanged since 2007; the 14% increase in flight capacity has been achieved through a combination of increased capacity and a denser cabin.

Besides, the financial results have been enormously positive, with this area representing half of the profitability of the global airline industry since 2013. The airlines’ right financial condition in the region places it in a privileged position to continue with its expansions, as well as the renewal of its fleets for the next 20 years.

A reliable internal network of air routes

North America is home to some of the most massive passenger air traffic flows in the world, including the largest today, the US domestic market. Two decades ago, over 80% of the seats offered were in local markets.

Today, while the internal market has grown, its overall share has declined to 75%. This change has been largely due to American international market growing, which now accounts for 22% of the seats offered to and from the region.

International markets growth over the last ten years was also higher than that of domestic and intraregional markets, with a 5.6% growth rate, compared to 2.1% and 3.6% respectively.

Since 1998, the proportion of seats offered to and from the region by North American carriers has been relatively stable. While there has been some fluctuation, with North American airlines reaching about 54%, interestingly at the time of the last financial crisis, their share is about the same today as it was twenty years ago.

The world’s largest inter-regional commercial aviation market

North America is the largest intra-regional market, representing 18% of global passenger traffic in 2018. Although the long-term traffic growth rate is estimated at 2.6%, below the world average, the size of this market contributes significantly to the increase in demand for single-aisle aircraft.

In the long term, international traffic is expected to grow faster than the local market, by approximately 4% per year. This increase is driven by the opportunities that are emerging from emerging markets.

Wide-body aircraft, which will account for 72% of deliveries over the next 20 years, offer US airlines the ability to operate non-stop flights profitably from both their primary and secondary hubs, thereby taking advantage of market opportunities.

Rising commodity prices and increased exports are expected to revive the region’s economic growth.

In addition to developments in world commodity markets, the expansion of domestic markets, the growth of the middle-class population and further regional integration will support long-term economic growth.

Economic growth is an active driver of commercial aviation and is, therefore, an important variable when traffic forecasting.

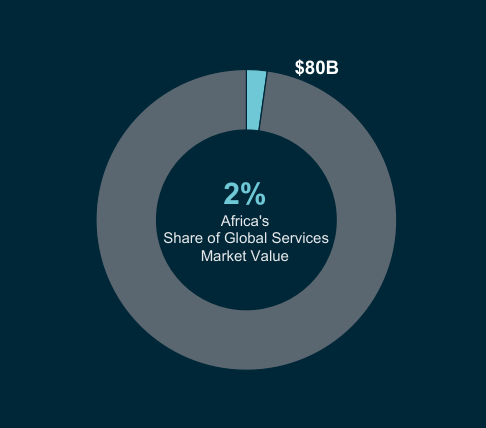

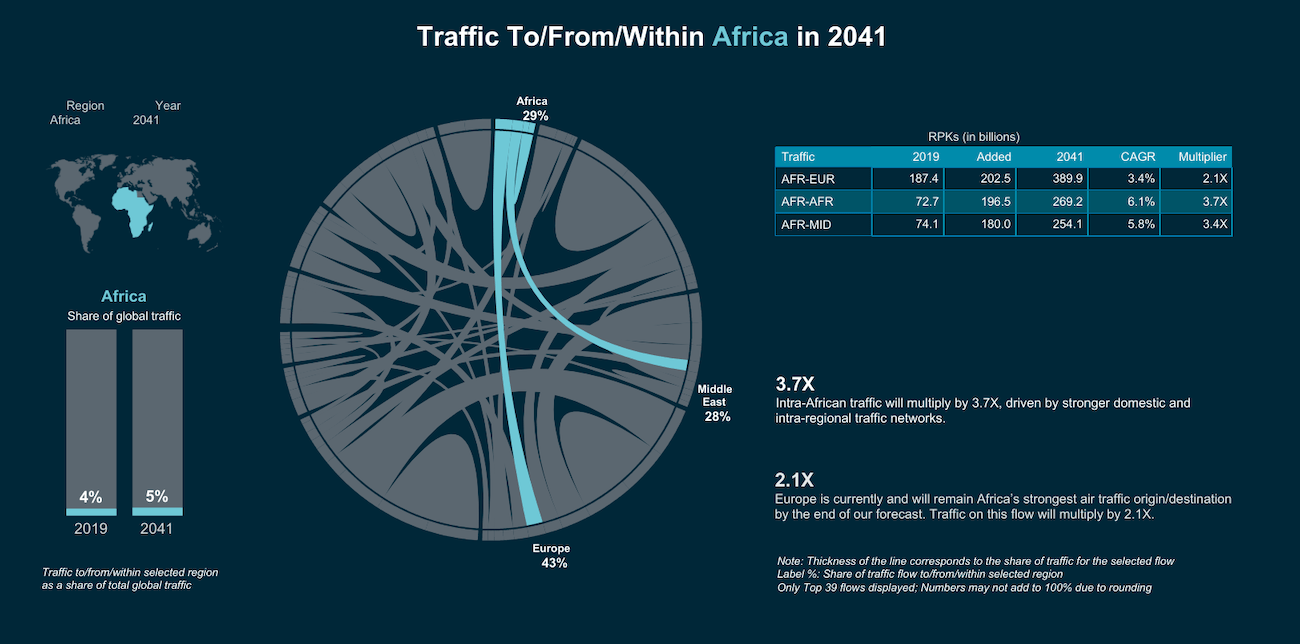

When looking at Africa, it is encouraging to note that in 2019, four of the ten fastest-growing countries were from the continent.

In the longer term, Africa’s real GDP is expected to grow at a rate of 3.6% per annum over the next 20 years. Improvements in infrastructure, more excellent political stability, economic diversification and regional integration would enhance this vision by helping the region to exploit its economic growth potential better.

Air transport liberalisation in Africa

The concept of air transport liberalisation in Africa emerged in 1988 with the adoption of the Yamoussoukro Declaration, followed in 1999 by the Yamoussoukro Decision.

This agreement provides for the entire intra-African air transport services liberalisation in terms of market access, free exercise of traffic rights for scheduled passenger air services, and free exercise of traffic rights for cargo services by eligible airlines.

It also removes ownership restrictions and provides for full liberalisation of frequencies. To implement this decision, the African Union has developed a flagship project called the Single African Air Transport Market (SAATM) as part of its Programme 2063.

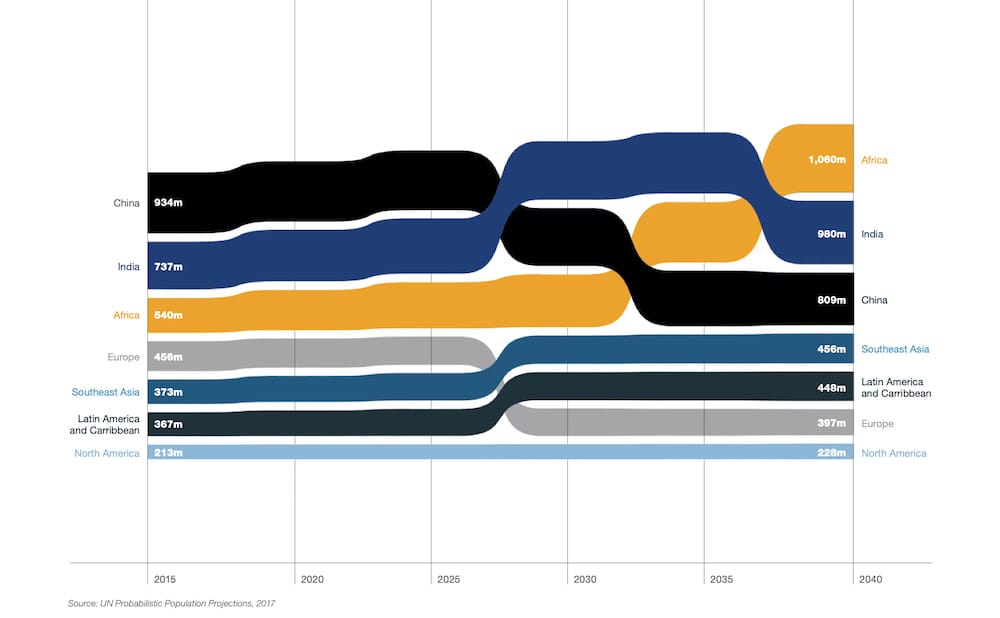

In the following graph, you can see the evolution of the working population in Africa over the next 20 years. From it, we can conclude that this is a region with incredible business potential for future commercial aviation.

To date, 28 countries have accepted SAATM since its launch in 2018: Burkina Faso, Benin, Botswana, Cameroon, Central African Republic, Cape Verde, Congo, Chad, Côte d’Ivoire, Egypt, Ethiopia, Gambia, Gabon, Guinea Conakry, Ghana, Kenya, Lesotho, Liberia, Mozambique, Mali, Niger, Nigeria, Rwanda, South Africa, Sierra Leone, Swaziland, Togo, and Zimbabwe.

These countries account for more than 80% of the current aviation market in Africa. About half of them have also signed a Memorandum of Implementation, committing themselves to unlock the benefits of aviation in their respective states.

Commercial aviation provides a bridge for internal and external communication

Africa is the second-largest continent in the world, behind Asia, and covers about one-fifth of the Earth’s total land area.

About half the continent lies on equator either sides and is surrounded by the Indian and Atlantic Oceans, with the Red and Mediterranean Seas to the north and east.

Theories suggest that it was the origin of humanity, with its current population of about 1.3 billion people with challenges to the development of land infrastructure coming from investment or simply from its geography and climate.

Data from the African Development Bank suggest that the region has two kilometres of built roads for every 100 km2 of land area and 46,000 km of railways, compared to 122 km for every 100 km2 and 86,000 km of road and railways in Europe.

Consequently, air transport plays an essential role in connecting African countries to each other and the rest of the world.

A slower pace of liberalisation than in other countries

In the last 20 years, 138 million additional seats have been added to routes to, from and within Africa, almost tripling since 1999.

This impressive growth has been achieved even though the pace of liberalisation in Africa, particularly among the African States, has been slower than in other continents.

So it is not unreasonable to suggest that the pace of growth and the benefits obtained could have been more significant during that time with further liberalisation.

The relaxation or simplification of immigration procedures can also be a powerful and instantaneous driver of growth in commercial aviation. The African visa opening rate stated in 2018:

- African citizens do not need a visa to travel to 25% of other African countries (compared to 22% in 2017 and 20% in 2016).

- Also, 24% of other African countries (even 24% in 2017, and 25% in 2016) can obtain visas on arrival.

- Africans need visas to travel to 51% of other African countries (compared to 54% in 2017 and 55% in 2016).

Over the next two decades, passenger traffic in this region is expected to grow at a rate of 5.5% per year. The main reasons for this are the growth of the middle class, which is more likely to travel, and expected economic growth.

In addition, the accelerated retirement of older and less efficient fleets will result in the Asia-Pacific region demanding more than 17,000 new aircraft, both passenger and cargo.

In a region where more than 55% of the world’s population lives, economies such as China, India and even Vietnam and Indonesia are expected to be the main drivers of growth in the region.

New manufacturing centres in Vietnam or Indonesia have the potential to enhance growth in commercial aviation traffic.

Regional sources of growth, in particular, private consumption, led by China’s economic conversion to services, will play a more critical role in the next years.

Despite the recent modest slowdown, the Asia-Pacific region will continue to lead global economic growth, with average real GDP growth projected at 4.1% per annum over the next 20 years.

Asia-Pacific accounts for 40% of global aircraft deliveries

Ten years ago, Asian low-cost airlines barely operated wide-body aircraft for the medium and long-range market segments. Today, Asian-based low-cost carriers are flying nearly 100 wide-body aircraft, with many more in the pipeline.

Meanwhile, wide-body aircraft represent the most cost-effective way to continue opening up new markets that were not accessible or productive in the past. In China, international growth continues to accelerate at over 20% per year.

Small wide-body aircraft such as the Boeing 787 have been vital in opening new routes in smaller secondary markets; while larger wide-body aircraft have been instrumental in opening up routes from major centres to North America.

This market dynamism will lead to the need for new aircraft for the area; in particular, it is estimated that more than 16,000 new aircraft will be delivered by 2038. Of these, around 4,000 will be used to replace older units, while more than 12,000 aircraft will be new additions to the Asia-Pacific fleet.

Learning to fly a plane is a recurring dream for many people. Not everyone succeeds, as the requirements demanded to make it a complex task and all those students who want to realize this dream must strive to achieve it.

At present, pilot training has become international, that is, the crisis that the sector has experienced in Spain has caused many pilots to seek new professional adventures in other countries.

Looking for employment alternatives in other countries is one of the tangible realities of pilots, both national and international. Because of this, commercial aviation is committed to quality training with the latest technologies and the best facilities.

At Grupo One Air, we know that this fact opens a range of essential possibilities to become reference pilots among the significant companies in the aviation sector.